In at the moment's fast-paced world, monetary emergencies can come up at any second. Whether or not it is an unexpected medical invoice, automobile repairs, or a home enchancment challenge, getting access to funds shortly might be crucial. Sadly, for these with bad credit score, acquiring a personal loan can really feel like an uphill battle. Nevertheless, there are choices accessible that may also help people with poor credit score scores secure the financing they need. This article explores some of the best personal loans to acquire for personal loans for bad credit online instant approval these with bad credit, together with tips on how to enhance your chances of approval.

Understanding Bad Credit score

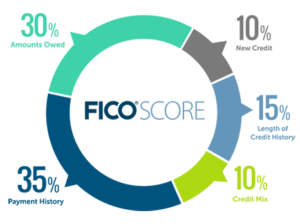

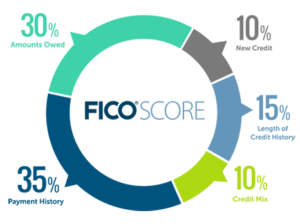

Earlier than diving into loan choices, it’s important to know what constitutes dangerous credit score. Generally, a credit rating beneath 580 is taken into account poor. Components that contribute to a low credit score rating include missed funds, excessive credit utilization, defaults, and bankruptcies. Lenders view people with unhealthy credit score as excessive-danger borrowers, making it extra difficult to secure loans and often resulting in increased interest charges.

Varieties of Personal Loans for Bad Credit

- Credit Union Loans

Credit unions are member-owned financial establishments that always present loans to people with lower credit scores. They sometimes have more lenient lending criteria in comparison with traditional banks. If you’re a member of a credit union, consider applying for a personal loan. They might offer decrease curiosity charges and more versatile repayment

phrases.

- Peer-to-Peer Lending

Peer-to-peer (P2P) lending platforms connect borrowers directly with particular person traders. These platforms, akin to LendingClub and Prosper, typically consider components beyond just credit scores, comparable to revenue and employment history. This can make it easier for people with unhealthy credit to secure loans. Nonetheless, curiosity rates could differ significantly primarily based on the perceived danger of the borrower.

- Secured Personal Loans

A secured personal loan requires the borrower to supply collateral, equivalent to a automotive or financial savings account. As a result of the lender has a guarantee that they will recover their losses if the borrower defaults, secured loans are often easier to obtain for individuals with dangerous credit. However, borrowers must be cautious, as failing to repay the loan may consequence in the lack of the collateral.

- Payday Loans

Though payday loans are simple to obtain, they include extraordinarily excessive-interest charges and fees. These quick-term loans are usually due on the borrower’s next payday and might trap people in a cycle of debt. It's advisable to make use of payday loans solely as a final resort and to discover different options before committing to any such borrowing.

- On-line Lenders

Many on-line lenders concentrate on offering loans to people with bad credit score. These lenders usually have streamlined application processes and can present funds rapidly. Firms like Avant and OneMain Financial cater specifically to these with decrease credit scores. Nonetheless, borrowers should rigorously evaluation the terms and interest rates, as they are often larger than these offered to people with good credit.

Components to contemplate When Applying for a Personal Loan

- Curiosity Charges

Curiosity rates can fluctuate significantly based on the lender and the borrower’s credit profile. It’s essential to check charges from multiple lenders to ensure you’re getting the very best deal. Even a small distinction in curiosity rates can lead to substantial savings over the life of the loan.

- Loan Terms

The size of the loan can influence month-to-month funds and the whole curiosity paid. Shorter loan phrases may have greater month-to-month payments however will result in much less curiosity paid total. Conversely, longer loan phrases will decrease monthly funds however improve the whole interest price.

- Fees and Expenses

Some lenders could cost origination fees, prepayment penalties, or late cost fees. It’s crucial to learn the nice print and perceive all associated prices earlier than committing to a loan.

- Repayment Flexibility

Look for lenders that provide versatile repayment choices. This can embody the flexibility to alter payment due dates or make further funds without penalties. Flexibility may be beneficial if your monetary scenario adjustments.

- Customer support

Good customer service could make a big difference in your borrowing experience. Search for lenders with constructive reviews relating to their buyer assist, as this may help ease the process if you encounter issues during repayment.

Tips for Improving Your Chances of Approval

- Verify Your Credit Report

Earlier than applying for a loan, check your credit score report for errors or inaccuracies. In case you have any questions relating to where and how to work with personal loans for bad credit online instant approval (

karjerosdienos.vilniustech.lt), you possibly can contact us on our own site. Disputing any mistakes can improve your credit score rating and enhance your possibilities of loan approval.

- Consider a Co-Signer

If possible, consider asking a buddy or household member with good credit to co-sign your loan. A co-signer can present further assurance to the lender, growing the probability of approval and potentially decreasing the curiosity charge.

- Show Stable Earnings

Lenders wish to see that you've a dependable source of earnings. Offering documentation of your employment historical past and revenue can strengthen your application.

- Restrict Purposes

Making use of for multiple loans in a short period can negatively impact your credit rating. As a substitute, research lenders and apply to these which are most more likely to approve your software based mostly in your credit profile.

- Build a Relationship along with your Lender

If you have an existing financial institution or

personal loans for bad credit online instant approval credit score union relationship, consider discussing your state of affairs with them. They may be more keen to work with you if they have a history of your banking habits.

Conclusion

Whereas acquiring a personal loan with unhealthy credit will be difficult, it is not inconceivable. By exploring various choices, such as credit score unions, peer-to-peer lending, and on-line lenders, people can discover options to their financial wants. Careful consideration of loan phrases, interest charges, and fees, personal loans for bad credit online instant approval along with proactive measures to improve creditworthiness, personal loans for bad credit online instant approval can lead to a profitable borrowing expertise. Remember to strategy borrowing responsibly and to solely take on debt that you would be able to manage inside your financial means. With the right technique, securing a personal loan with dangerous credit can be a stepping stone to higher monetary health.