Understanding Gold IRAs: A Comprehensive Information To Treasured Stee…

페이지 정보

작성자 Victor 작성일 25-07-24 12:30 조회 16 댓글 0본문

In recent years, the allure of investing in gold has gained significant traction, significantly among those seeking to diversify their retirement portfolios. A Gold Particular person Retirement Account (IRA) provides a novel alternative for buyers to incorporate treasured metals of their retirement financial savings technique. This text will discover what Gold IRAs are, how they work, their advantages, and the concerns to keep in mind when investing in them.

What is a Gold IRA?

A Gold IRA is a type of self-directed Individual Retirement Account that allows investors to carry physical gold, silver, platinum, and palladium in addition to traditional investments like stocks and recommended companies for gold-Backed ira bonds. In contrast to customary IRAs, which usually hold paper belongings, Gold IRAs provide a strategy to invest in tangible property which have intrinsic value. This may be particularly appealing during times of economic uncertainty or inflation.

How Does a Gold IRA Work?

Setting up a Gold IRA includes a number of steps:

- Choose a Custodian: The first step is to select a custodian. A custodian is a monetary institution that manages the account and ensures compliance with IRS laws. It’s essential to decide on a reputable and skilled custodian specializing in precious metals.

- Fund the Account: Buyers can fund their Gold IRA by varied methods, together with rolling over funds from an current retirement account (like a 401(ok) or conventional IRA) or making direct contributions. It’s important to adhere to IRS contribution limits and rules relating to rollovers.

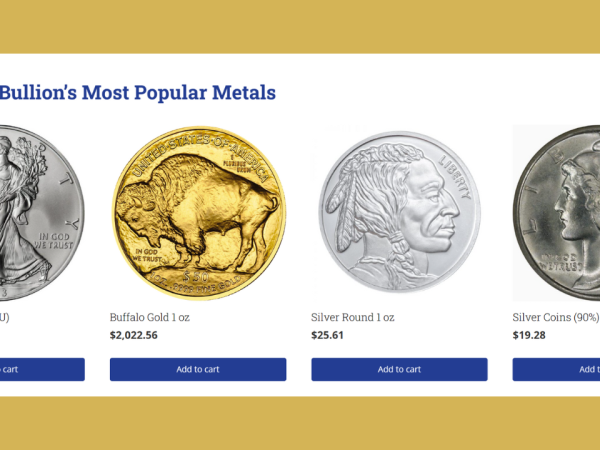

- Select Accredited Valuable Metals: The IRS has specific pointers regarding the sorts of metals that can be held in a Gold IRA. Only sure coins and bullion that meet minimum purity standards are eligible. For instance, American Gold Eagles, Canadian Maple Leafs, and sure bars from approved refiners are commonly accepted.

- Storage: Physical gold and other treasured metals must be stored in an authorised depository. The IRS requires that these belongings be kept in a secure, insured facility, ensuring their security and integrity. Traders cannot take private possession of the metals whereas they are held in the IRA.

- Withdrawals and Distributions: When it comes time to retire, buyers can take distributions from their Gold IRA. These distributions will be in money or bodily metals, but they are topic to taxation. Should you adored this information and you would want to be given more information with regards to recommended companies for gold-backed ira i implore you to go to our web-page. If the metals are withdrawn, they are treated as unusual earnings and should incur additional taxes if taken before the age of 59½.

Benefits of Investing in Gold IRAs

Investing in a Gold IRA affords several potential benefits:

- Hedge Against Inflation: Gold has historically been seen as a hedge against inflation. During intervals of rising costs, gold usually retains its worth or appreciates, making it a safe haven for buyers.

- Diversification: Including gold in a retirement portfolio can provide diversification. Valuable metals typically have a low correlation with traditional property like stocks and bonds, which might help scale back overall portfolio danger.

- Tangible Asset: Not like stocks or bonds, gold is a physical asset that investors can hold. This may present a way of security, especially throughout financial downturns when financial markets are risky.

- Potential for Development: While gold prices can fluctuate, many buyers imagine that over the long run, the worth of gold will increase. This potential for appreciation can improve retirement savings.

- Tax Benefits: Gold IRAs offer the identical tax benefits as conventional IRAs. Contributions may be tax-deductible, and investments develop tax-deferred till retirement.

Concerns When Investing in Gold IRAs

Whereas Gold IRAs provide numerous benefits, there are additionally necessary considerations to bear in mind:

- Fees and Costs: Establishing and maintaining a Gold IRA can involve numerous charges, together with custodian fees, storage fees, and transaction charges. It’s important to know these costs upfront and factor recommended companies for gold-backed ira them into your funding technique.

- Market Volatility: The worth of gold might be unstable, influenced by numerous components akin to economic circumstances, geopolitical events, and market hypothesis. Investors should be prepared for worth fluctuations and consider their threat tolerance.

- IRS Laws: The IRS has strict laws regarding Gold IRAs, including the sorts of metals that can be held and the storage requirements. Non-compliance may end up in penalties or the disqualification of the IRA.

- Restricted Progress Potential: Whereas gold can function a hedge against inflation, it doesn't generate earnings like stocks or bonds. Buyers should consider how gold suits into their general funding strategy and retirement goals.

- Liquidity Considerations: recommended companies for gold-backed ira Promoting bodily gold could be less liquid than promoting stocks or bonds. Buyers could face challenges when attempting to sell their gold rapidly, particularly in a fluctuating market.

Conclusion

Gold IRAs present a singular alternative for traders trying to diversify their retirement portfolios and recommended companies for gold-Backed ira protect their wealth in opposition to financial uncertainties. By understanding how Gold IRAs work, their benefits, and the potential drawbacks, investors can make informed decisions about together with valuable metals in their retirement strategy. As with any investment, it’s advisable to consult with a financial advisor to ensure that a Gold IRA aligns with your overall monetary goals and threat tolerance. With careful planning and consideration, a Gold IRA could be a worthwhile addition to your retirement savings technique, offering each security and potential for development in an ever-changing economic landscape.

- 이전글 Секреты успеха: почему украинские локации привлекают российских продюсеров

- 다음글 Take Advantage Of Highstakes Casino Download - Read These 6 Tips

댓글목록 0

등록된 댓글이 없습니다.